Thematic investing: Renewable energies and a circular economy

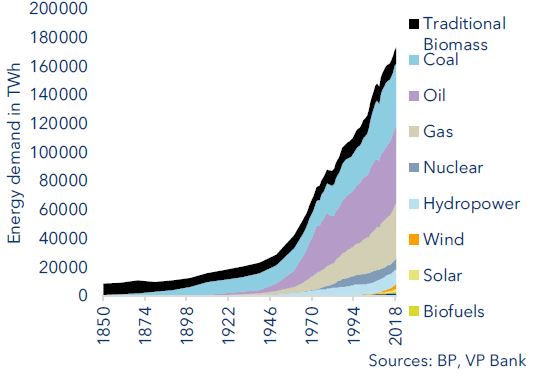

The demand for energy is growing ceaselessly. Global economic and population growth will ultimately result in an additional 50% increase in energy use by 2050. Alas, today’s energy transition efforts still fall short of accommodating this future reality. Since 2015, the output from renewable energy sources has increased by a total of 3,700 terawatt-hours (TWh). For the sake of comparison, electric power consumption in the USA alone in 2020 amounted to 3,800 TWh. At the same time, though, demand for oil and natural gas increased by 7,240 TWh.

Global energy demand (in terawatt-hours)

Without a concerted global effort, the agreed climate goals will be unachievable. In this regard it was pivotal that the goals of the 2015 Paris Climate Accords were confirmed at the recent United Nations Climate Change Conference in Glasgow (COP26): the participating nations recommitted to the previously established interim targets for 2030, which are to be achieved by reducing coal as an energy source, putting a stop to deforestation, reducing methane emissions and furthering the development of so-called green technologies.

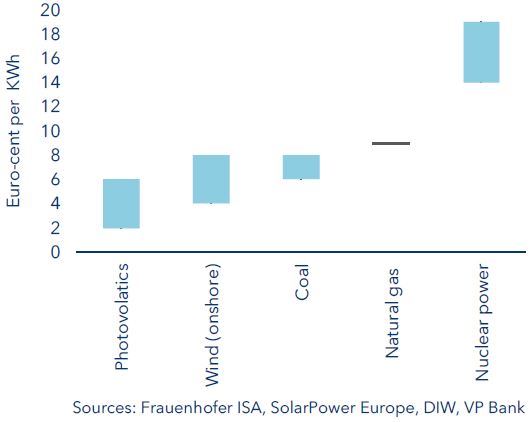

Many “green” energy sources have become more attractive these days thanks to technological advances and government subsidies. Today, wind and hydroelectric power plants generate electricity at lower overall costs than fossil fuels. Moreover, electricity from biomass, geothermal energy and photovoltaics is already price-competitive in many countries. Going forward, if the damages caused by ecologically and physically harmful emissions were to be prorated to the various energy sources, the clear cost advantage of renewable energies will become evident.

Photovoltaics is an excellent example of what can be achieved through technological progress and economies of scale: since 2010, the cost of a kilowatt-hour of solar electricity has decreased by more than 80%. This means that for new installations, solar power – even without state subsidies – is already cheaper than nuclear energy.

Power generation costs in Europe

The changeover to renewable energies entails major challenges, two of which are the increased dependency on weather conditions for the generation of electricity, and a power grid that has yet to be sufficiently coordinated for decentralised production. In the recent past, this has been clearly evidenced in Germany. In 2019, a potential 6.3 billion-kilowatt hours’ worth of electrical power generation was lost due to too much wind – an amount that otherwise could have supplied 5% of the households in Germany with electricity for an entire year. There was simply a lack of the necessary transmission capacities and control systems between production and consumption.

Due to the fact that these new sources of power generation are decentralised, the intensifying use of renewable energies means not only that the existing electricity grids are in urgent need of modernisation, but also that leading-edge technologies must be deployed for the diversified downstream processing of the primary resource, namely electricity.

Green hydrogen

Modernisation and leading-edge technologies also come into play in connection with the strategic plans of several industrial nations for the use of hydrogen as a fuel. Currently, hydrogen is mainly produced with nuclear power or natural gas. But if one takes into account the overall costs, “green” hydrogen production (which is based on renewable energies) is already competitive today.

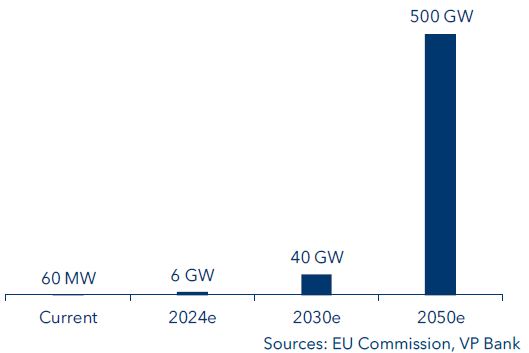

The European Union’s recently announced “Fit for 55” package underscores how important the use of hydrogen is deemed to be for the Old Continent. This initiative establishes detailed milestones on the road to climate neutrality by 2030, with the aim of reducing greenhouse gas emissions in Europe by 55%. In terms of electromobility and emission-reduced roadway transport, the EU Commission has proposed in its draft ordinance of July 2021 that hydrogen filling stations be installed along the motorways of EU member states every 150 kilometres. The electrolysis capacity necessary for hydrogen production as foreseen by the EU is to increase from a present 60 megawatts (MW) to 6 gigawatts (GW) in 2024 and 40 GW by 2030. For 2050, the point at which the EU intends to be climate neutral, a capacity of 500 GW is envisaged.

Total electrolysis capacity as called for by the EU Commission

Analysts at US investment bank Goldman Sachs estimate that the necessary outlays for the related infrastructure will amount to some EUR 325 billion, and that the potential investment sum along the entire value chain could reach EUR 2 trillion by 2050 in Europe alone. The total worldwide expenditures are estimated at EUR 10 trillion.

The circular economy

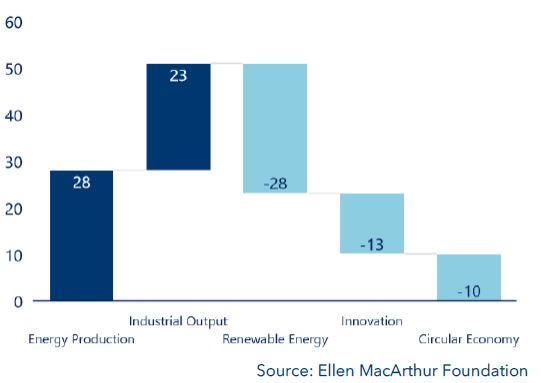

The climate targets set for energy production by 2050 have a real chance of being achieved either in full or at least to a large extent. Energy production also involves transport and heat generation. Globally, this accounts for roughly half of all greenhouse gas emissions; but that is only half the battle, and the goal of limiting global warming to a mere 1.5° C will not be achieved with these efforts alone. What remains is the role played by the manufacturing and agricultural sectors. Their emissions amount to an estimated 23 gigatons per year worldwide. Here, the comprehensive development of a global circular economy constitutes a crucial element of the solution. Doing so will reduce greenhouse gas emissions by an estimated 10 trillion tonnes.

In essence, this is a matter of creating a regenerative production system in which the use of resources and the production process are minimised by the so-called “6Rs” – Reuse, Recycle, Redesign, Remanufacture, Reduce, and Recover – which slow, streamline and interlock energy and materials life cycles. Longer product life cycles, as well as product maintenance and secondary applications, are therefore important aspects. And of course, intelligent recycling rounds out the circular economy process as it returns the original resources to the loop for renewed utilisation.

CO2 reduction by 2050 (in billions of tonnes)

A hybrid circular-economy/technological-innovation approach is being taken by Swiss start-up Enespa as well as the publicly traded Norwegian firm Quantafuel. Both have developed independently a process to convert plastic waste back into so-called oil fractions by means of thermolysis. Due to the lower weight of the resulting paraffin oil, about 1,000 litres of high-quality feedstock for the plastics industry are recovered from one tonne of plastic waste.

The “sharing industry,” which facilitates the exchanged utilisation of goods or services, plays an important role in the circular economy. It is also urgently needed: according to the renowned Ellen MacArthur Foundation, the projected economic growth through 2050 will require natural resources in an amount equivalent to 1.6 times the Earth’s capacity. The industrial extraction of raw materials has increased 13-fold in the past 70 years and is responsible for 90% of all environmental damage and water stress. Sharing has a long tradition; rural cooperatives are just one example. In today’s world, many people have already had experience with providers such as Uber, Spotify or Airbnb, without ever having thought about becoming part of the industry themselves. The relentless advance digitalisation is increasing the efficiency and thus the acceptance of such services. The related apps bring together people with corresponding interests and make the interaction convenient and transparent. The five largest industry segments are accommodation, car hire, music/video, employment services and financial intermediation. Management consultants PricewaterhouseCoopers expect the market in these areas to grow to USD 335 billion by 2025, the same amount as the traditional temporary-use sector. In terms of Europe’s circular economy, consulting firm McKinsey foresees annual productivity growth of 3% through 2030, which represents a value-creation potential of EUR 600 billion. And on another note, the Ellen MacArthur Foundation recognises in the food industry alone a global value creation potential of USD 2.7 trillion through 2050 thanks to the sustainable and circular management of large cities.

Summary

Renewable energies and the circular economy are means for reducing CO2 pollution and helping in the global effort to treat the environment, which has been severely damaged by industrialisation, more gently in the future. As a part of this, infrastructure builders/equippers and greentech companies, for example, will be creating jobs and enhancing productivity – a highly attractive combination in the eyes of the capital markets. The urgently needed measures require enormous investments on the part of governments, companies and private households. Investors can play a positive role in this regard and expect attractive returns for doing so.

Specifically, we have two suggestions on how these themes can be addressed via funds. Please contact your cliend advisor.

Important legal information

This document was produced by VP Bank AG (hereinafter: the Bank) and distributed by the companies of VP Bank Group. This document does not constitute an offer or an invitation to buy or sell financial instruments. The recommendations, assessments and statements it contains represent the personal opinions of the VP Bank AG analyst concerned as at the publication date stated in the document and may be changed at any time without advance notice. This document is based on information derived from sources that are believed to be reliable. Although the utmost care has been taken in producing this document and the assessments it contains, no warranty or guarantee can be given that its contents are entirely accurate and complete. In particular, the information in this document may not include all relevant information regarding the financial instruments referred to herein or their issuers.

Additional important information on the risks associated with the financial instruments described in this document, on the characteristics of VP Bank Group, on the treatment of conflicts of interest in connection with these financial instruments and on the distribution of this document can be found at https://www.vpbank.com/legal_notice_en